Vedant Fashions, the largest company in India in the wedding segment and Indian celebration in India, has a fixed problem price at RS 866 per share, the top tip of the ribbon price, for initial public offering. The problem price is Rs 824-866 per share.

Initial Public Offering (IPO) More than RS 3.63 Crore Equity Stock, at a price of more than Rs 866 per share, taking the company Rs 3.149.19 Crore. Public problems only consist of one offer for sale by Investors (Holdings Rhine, and Alternative Investment Funds Kedaara – Kedaara Capital Aif 1), and promoter Ravi Modi Family Trust Therefore, all the problems will go to sell shareholders and the company will not receive IPO money.

Promoters and investors sell total equity shares 14.98 percent through public problems The company is worth RS 21,017.36 Crore, which is called market capitalization, with the final price of Rs 866 per share price Public issues do not accept large responses from investors, especially retail and non-institutional investors whose parts provided by subscribing to 39 percent and 1.07 times respectively.

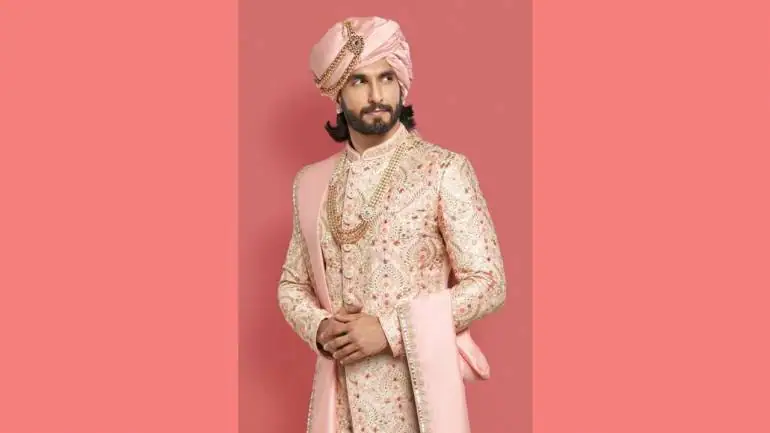

This problem was mainly supported by qualified institutional buyers on the last day of subscribing, February 8, whose portion was booked 7.49 times, helped total problems get 2.57 times. The offer was opened to subscribe on February 4th Vedanta Fashions, with Flagship brand ‘Mangvar’ and four other brands (Twamev, Mantan, Mehey, & Mebaz), offer a stopped destination with a broad spectrum of product offers for every chance of celebrations.

The company produces sales through exclusive brand outlets belonging to franchises (EBO), with the rest by multi-brand outlets (Mbo), large format stores (LFSS) and online platforms, including website and cellular applications The trade premium in the gray market fell further to zero-to-rs 10, from the previous 40-50 RS, against the price of the issue of Rs 866 per share, according to the IPO Watch and the Central IPO.

The warm response from investors to public problems and too much market volatility amid fears for faster tightening by the central bank globally to combat inflation can be the main reason for the gray market premium decline The company will complete the allotment of IPO shares on Friday, February 11. Investors can check their application status online both through the BSE website or IPO Registrar Website.

The funds will be returned to unsuccessful investors on February 14 and equity stocks will be credited to the Demat Investor account that qualifies on February 15 The company will make a debut on the stock exchange on February 16, according to the details available in the prospectus.